Project information

Concept Work: Student Project

Overview

Sprout is a financial education and management tool designed to empower users and elevate their financial life. Users have access to easy-to-understand, actionable content related to financial literacy, saving and budgeting tools, and tools to manage active subscriptions and recurring bills. Sprout aims to create high quality, reliable tools for learning financial literacy, equipping users with insights and controls to navigate and enhance their financial adventures confidently.

This project was created at SCAD from September to November, 2023, while learning Information Architecture by Professor Anthony O'Rourke.

My Role

Project Manager

Mobile UI Designer

Product Designer

Collaborators

Nick Kubach

Research Lead

Web UI Designer

Anna Young

Design Lead

Problem

Most young adults feel unsure about critical financial concepts such as saving, using credit, taking out loans, insurance, investing, and filing taxes. This lack of financial knowledge indicates that young adults feel financially unprepared, which could impair their ability to make sound financial decisions as they enter adulthood.

Why this problem?

As young adults begin to separate from their parents' finances, many aren't set up for success, as modern-day education does not cover critical financial concepts like saving money, filing taxes, and purchasing insurance. Our goal is to provide users with actionable and easy-to-understand financial literacy education that is tailored to their individual needs and leaves them feeling empowered.

How might we…

…educate users along their financial journey, ranging from beginner to expert level?

…address the financial concerns of young adults while facilitating fiscally responsible habits?

Who's the target audience?

Our target audience focuses heavily on Generation Z.

Solution

1/2: Mobile App

Home

Access your bank account(s) balance(s) anytime, check recent transaction history across multiple financial accounts, monitor and enhance your credit score, manage the Sprout Device, and review your active subscriptions and recurring payments.

Learn

Explore the latest posts on the Sprout Blog, discover tailored financial topics that relate to your account activity, and broaden your financial understanding in any area.

Wallet

View account balances and recent transactions from various financial institutions, and add a new account anytime.

Sprout Device control

Add and remove financial accounts on the Sprout Device, manage its security, locate a lost device, and control its settings.

2/2: Smart Sprout Device

Meet your wallet's best friend

Keep an eye on account balances with the on-the-go Sprout Device. Perfectly sized to fit into a wallet or purse pocket, the Sprout Device alleviates the need to check various bank accounts before making a purchase.

Built-in device security

Authenticate quickly using a notification from the Sprout app or input a custom PIN to access the device faster.

Pinned accounts

Pin most-used financial accounts to view their balance on the home screen. Accounts can be pinned to the Sprout Device using its mobile app companion.

Account balances

View linked account balances. Accounts can be linked to the Sprout Device using its mobile app companion.

UX Research

Validating our market

75% of teens lack confidence in their knowledge of personal finance.

35 states reported an average score of a C, D, or F for high school financial literacy.

Lack of financial literacy cost Americans a total of $436 billion in 2022.

50 survey respondents

86% aged 18-21

6% aged 22-25

8% aged 22-25

78%

of respondents reported they did not have any form of formal education about financial literacy.

84%

of respondents reported they did not feel confident with their current level of financial literacy.

What area of finance do users feel least confident in?

Survey respondents were asked to select all that apply

Saving

30%

Credit

47%

Taxes

81%

Insurance

78%

Investing

70%

I feel like there is an abundance of information out there so I can never make an informed decision.

DIRECT QUOTE FROM A SURVEY RESPONDENT

"I'm about to graduate college and I still have no idea how to file my own taxes.”

DIRECT QUOTE FROM A SURVEY RESPONDENT

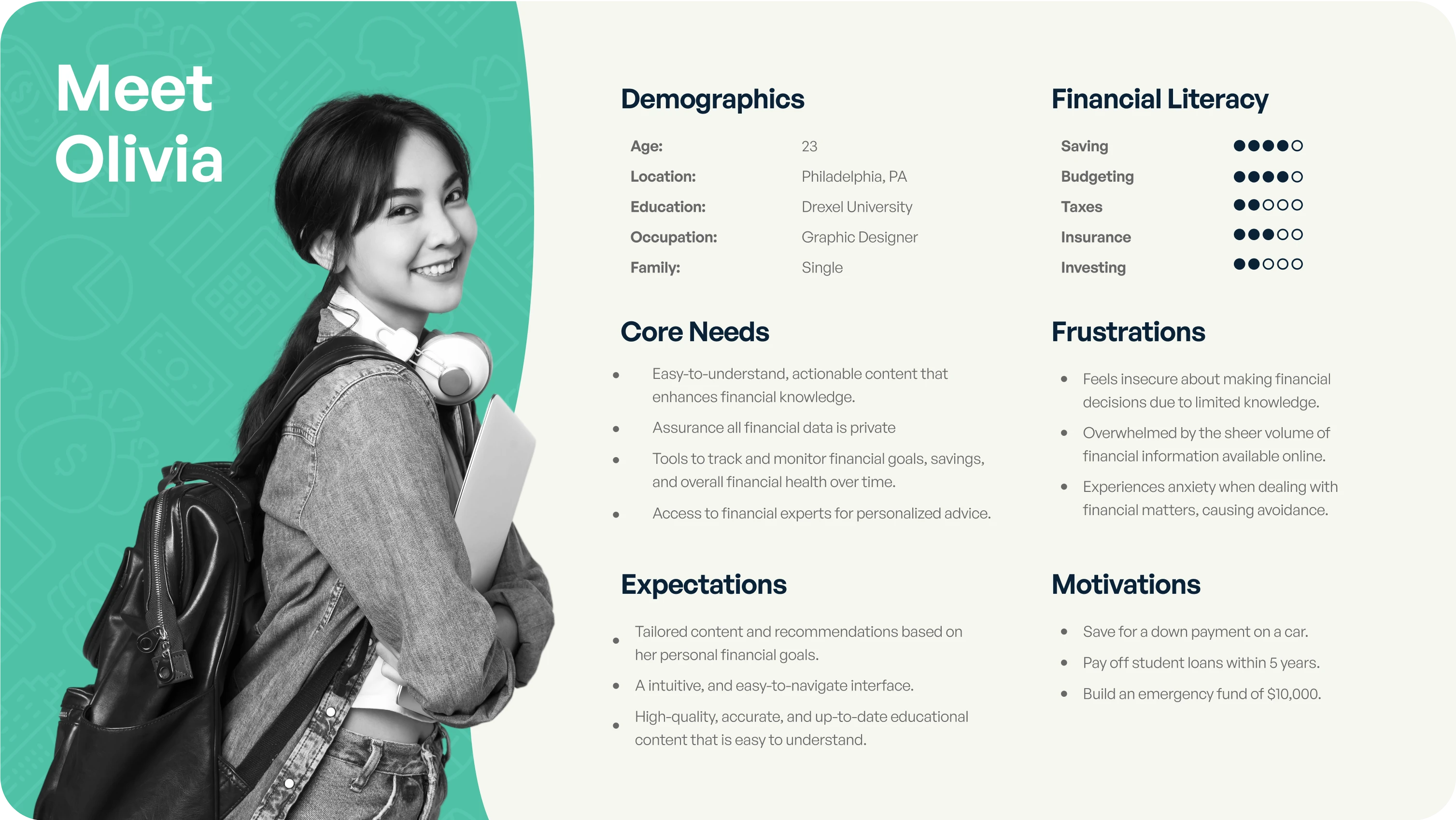

User Persona

Research findings

Convenience

Respondents reported they prefer using a debit card when making purchases. This informs us that users want an experience that is fast, easily accessible, and seamless.

Information Overload

The digital age offers endless information but also constant distractions. Sorting through online financial resources can be overwhelming, making it challenging to focus on essential financial concepts.

Stressor

Many respondents noted finance is often a major source of stress. This is often a symptom of not feeling educated on various financial concepts which often leads to avoidance of finance all together.

Web Information Architecture

Footer

Vision Video

Conclusion

Reflection

Sprout is the second UX project I've worked on. Empathy, the core concept for quality UX design, is baked into every aspect of Sprout. We wanted to address the stress that young adults often face due to a lack of a solid financial foundation.

As the project manager, I learned how to break down large due dates into smaller, more manageable tasks that could be assigned to my teammates. I also expanded my UI and product design skills by creating the Sprout Device, a portable financial device, and designing the interface for Sprout's mobile app. I'm really proud of what my team and I were able to accomplish in just ten weeks, and I've realized that financial technology could be a potential career path for me.